The release of the US Feb PPI allows us to complete our mapping of the US CPI & PPI into the US Core PCE Deflator - relevant for Fed policy.

In contrast to Core CPI/PPI, the details suggest that the US Feb Core PCE Deflator is poised to INCREASE SEQUENTIALLY to around 0.35% m/m (Jan: 0.28%).

Our estimate rounds to 0.3% m/m, but clearly we cannot even exclude a 0.4% print.

If confirmed by the official release (28 Mar), this would mark the strongest Core PCE deflator m/m increase since early 2024, reinforcing an ongoing pick-up in US inflation momentum.

It would result in a renewed pick-up in the annual rate from 2.6% to 2.8%, almost fully unwinding Jan’s -0.3pp decline, with the 3m and 6m changes also increasing (to 3.4% and 3.0% saar, respectively).

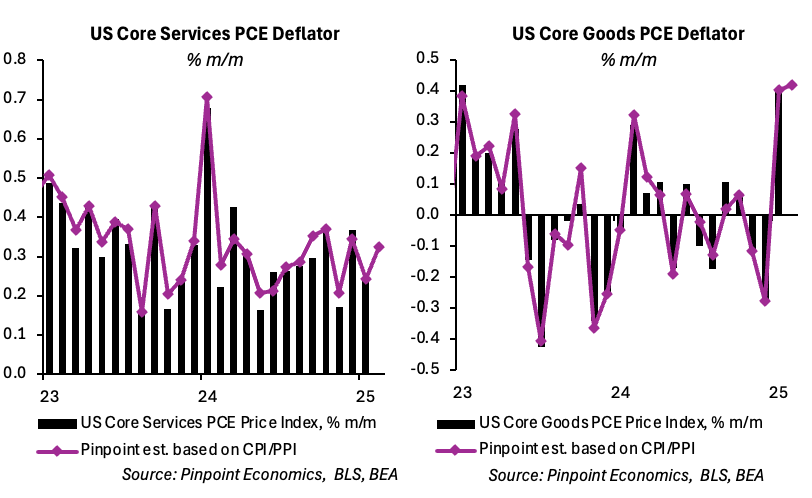

We expect the Core Services PCE price index to increase from 0.2% m/m in Jan to 0.3% m/m in Feb …

… while we maintain our view from yesterday that the Core Goods PCE price index will increase around 0.4% m/m for a second month.

Needless to say, the Core PCE indications are not as favourable as the headline readings of the US CPI and PPI implied, pointing to Core PCE inflation still running well-above target.

Overall, in line with yesterday’s note, we view the latest data as consistent with the Fed remaining on hold for the next couple of meetings a least, as it keeps a watchful eye on inflation risks from tariffs as well as rising risks to growth.