EMU Core Disinflation Supports Further ECB Easing

April Rate Cut Remains in Play (and Preferable to Waiting Until June)

“The continued decline in EMU Core inflation confirms the ECB’s baseline and supports further ECB easing. Another rate cut in Apr would be preferable to skipping and waiting until Jun, given that policy is still not yet back to ‘neutral’ and uncertainty over the outlook seems likely to persist for quite some time.”

EMU Core Inflation Points to Another ECB Rate Cut…

EMU headline inflation eased from 2.3% to 2.2% in Mar, in line with the Bloomberg Consensus f/c, leaving inflation in Q1 (2.3%) in line with the ECB f/c.

EMU Core inflation was friendly, dropping from 2.6% to a below-Consensus 2.4% (Cons: 2.5%), its lowest since Jan 2022.

This meant that, according to this flash estimate, Core inflation averaged 2.56% in Q1, a touch above the ECB’s 2.5% f/c.

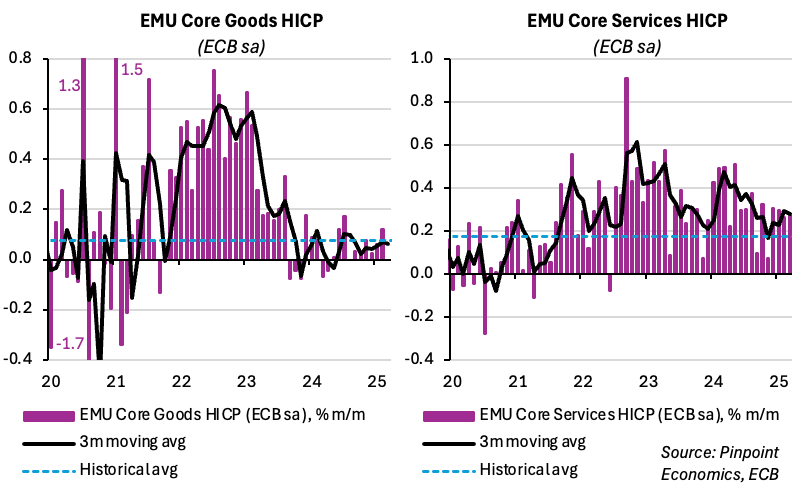

The details of Core inflation were also favourable, with (i) a further sequential slowdown (sa), and (ii) Services driving the drop in the y/y.

Indeed, Core prices slowed from 0.22% to 0.17% m/m on the ECB’s seasonally adjusted series, ie exactly in line with the ECB’s 2% target.

By sub-component, Core Goods prices slowed sequentially from +0.1% to flat m/m, while Core Services prices were stable at 0.27% m/m.

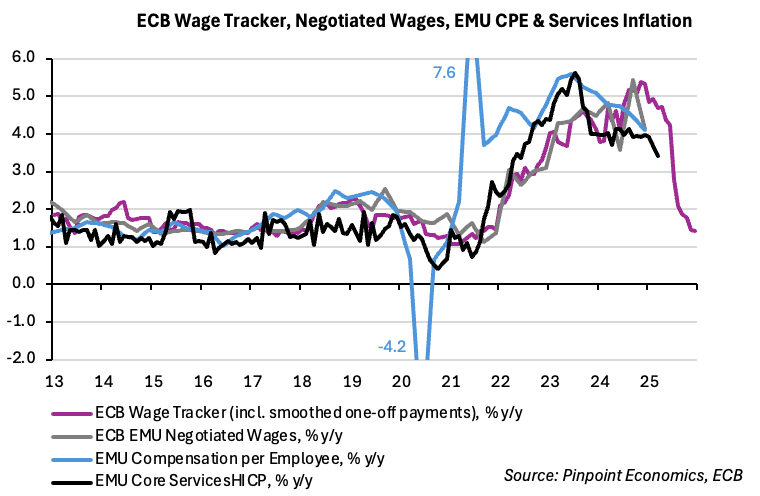

While there may have been some residual base-effect benefit from a later Easter this year compared to 2024 (working the opposite way next month), forward-looking indicators point to a continued disinflationary trend in Services.

… Apr Cut Still the Right Move, Rather Than Waiting Until Jun.

Overall, the inflation data confirm that the ECB’s baseline is broadly tracking and consistent with a further deposit rate cut to 2.25%.

While the inflation data may be consistent with another 25bp cut, the latest newsflow has raised some doubts as to whether it will come later this month, or the Council chooses to skip a meeting and cut next in Jun.

In particular, typically-dovish BdI Governor Panetta sounded a little less so yesterday, commenting:

“Looking ahead, we can’t yet say that the battle against inflation is over… It’s crucial that we monitor any factors that could prevent inflation from returning to its 2% target.”

Then a Bloomberg sources story reported yesterday that ‘several ECB officials are still wavering on whether to cut interest rates [in April], according to people familiar with the matter…’

Those people noted that ‘policymakers from across the hawk-dove spectrum are contemplating a pause at the 17 Apr meeting given heightened uncertainty’ over Trump’s trade policies and Europe’s military-spending surge.

‘Dovish officials still see the need for further loosening, but may not insist on a rate cut if their more hawkish colleagues want additional time to assess the data,’ the people said.

However, possibly in response, Finland’s Rehn - one of the more pragmatic and bellwether members on the Council - said earlier today:

“If the data verify the baseline and indicate that to reach our goal of 2% symmetric inflation target over the medium term, the right reaction in monetary policy should be to cut in April, we should indeed do so. But if data indicate something else, then we would pause.”

In our view, the incoming data verify the ECB’s baseline and a cut in Apr would be preferable to waiting until Jun, given that policy is still not yet back to ‘neutral’ and uncertainty over the outlook seems likely to persist for quite some time.

Nonetheless, we should be mindful of the Bloomberg sources story and recognise that the 17 Apr decision could yet be swayed by events over the next couple of weeks, not least the response/fallout to Trump’s ‘Liberation Day’ tariffs announcement.

At the time of writing, the market prices a 79% probability of a rate cut in Apr.

Overall, as we have noted previously (see ECB: Getting Closer But Not There Yet…, 6 Mar), our judgement remains that the Council consensus probably has in mind to get to a ‘terminal’ rate around 2% (ie. the mid-point of the 1.75%-2.25% ‘indicative’ range in a recent ECB staff paper), from which it will ‘wait and see’ how growth and inflation risks evolve.